ev charger tax credit 2022

For example new EV purchasers may qualify for up to 750 in state tax credits in California in 2022 under the California Clean Fuel Reward program. 2022 Electric Vehicle.

Ev Charging What You Need To Know About Charging Your Electric Vehicle

The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles.

. For residential installations the IRS caps the tax credit at 1000. Furthermore Future Energy expects federal tax incentives to be quite robust in 2022. The tax credit is retroactive and you can apply for installations made from as far back as 2017.

Because the new model is eligible for tax incentives a newer car model may be cheaper than a little driven older one. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs. The equipment must be used for business purposes.

By Andrew Smith February 11 2022. The new tax credit starts with a base amount of 4000 as it is today with another 3500 available if the vehicles battery pack includes at least 40 kwh of capacity for cars placed in service before 2027. The tax credit covers 30 of a companys costs.

18 hours agoThe Electric Vehicle Charging Equipment Rebate Program pays up to 90 of the cost of the charging station with a max amount of 3500 per port7000 per station for public properties fleets and multi-unit dwellings. The credit amount will vary based on the capacity of the battery used to power the vehicle. The credit ranges between 2500 and 7500 depending on the capacity of the battery.

Up to 4000 for the purchase of a used all-electric vehicle. Federal income tax credit of up to 7500 for eligible all-electric and plug-in hybrid cars purchased new in or after 2010. The federal government offers a tax credit for EV charger hardware and EV charger installation costs.

An EV with at least a 5 kWh battery capacity can snag you another 417 plus another 417 for each kWh above that 5 kWh threshold. Information specific to your state can be found on the US. Another 4500 is available if an automaker makes the EV in the US with a union workforce.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to. So if you recently installed a home EV charging station or completed a large-scale EV infrastructure project you might still be eligible for this. Grab IRS form 8911 or use our handy guide to get your credit.

SUBJECT Electric Vehicle Charging Station Tax Credit SUMMARY This bill under the Personal Income Tax Law PITL and the Corporation Tax Law CTL would allow a credit equal to 40 percent of the costs paid or incurred by the owners or. Currently the federal government offers a tax credit for both EV charger hardware and for installation costs. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations.

The tax credit now expires on December 31 2021. Black Hills Energy Residential EVSE Rebate. Congress recently passed a retroactive federal tax credit for those who purchased environmentally responsible transportation including costs for EV charging infrastructure.

The tax credit is retroactive and you can apply for installations made from as far back as 2017. Since installation costs are significant for EV chargers this rule allows you to get the most tax credit for your. Up to 600 for the purchase of a home charging station.

Residential installation can receive a credit of up to 1000. Jan 13 2022. Up to 1000 Back for Home Charging.

The credit amount varies by model and is determined by the battery capacity of the car. To learn which car models qualified for the complete federal tax credit go to FuelEconomygov a website run by the US Department of Energy. Unlike some other tax credits this program covers both EV charger hardware AND installation costs.

Black Hills Energy Commercial customers are eligible for a rebate up to 2000 per port for Level 2 chargers or up to 35000 for the installation of DC fast chargers. On a time-sensitive note the Alternative Fuels and Electric Vehicle Recharging Property Credit will expire at the end of 2022. The tax credit applies to each piece of EV charging equipment a business installs within New York and amounts to 5000 or 50 of the equipment cost whichever is less.

Keep in mind that the Canada EV incentives and rebates listed above may change depending on program availability. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. Similar tax breaks have expired and been extended in recent years and in its current form it applies to property placed.

You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. Department of Energys Federal and. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000.

Just buy and install by December 31 2021 then claim the credit on your federal tax return. Black Hills Energy residential customers are eligible for rebates of 500 for smart EV charging stations. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs.

Companies can receive up to 30000 in federal tax credit for commercial installations. It Pay to Plug In provides grants to offset the cost of purchasing and installing electric vehicle charging stations. Even an EV with a much smaller battery capacity say 16 kWh would max out the tax credit.

If so we have great news for you. However this credit has a deadline of december 31 2021 and may decrease in 2022 so its recommended that companies looking to install ev charging systems do so before that deadline. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25.

The federal tax credit was extended through December 31 2021. 58 rows The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. An amendment on the Federal year-end spending bill reinstated electric vehicle charger tax credits that expired in 2017.

Many EVs these days have a 100 kWh battery which would easily max out that 7500 credit. Another 500 is added for a US-made. Co-authored by Stan Rose.

Up to 5000 rebate on the installation of a charging station at your work or multi-unit residential building. A rather significant federal tax benefit is available to most taxpayers who recently installed electric vehicle charging stations and it seemingly is a feature that flew under the radar for many. As it stands the credit provides up to 7500 in a tax credit when you claim an ev purchase on taxes filed for the year you acquired the vehicle.

What S In The White House Plan To Expand Electric Car Charging Network Npr

5 Ways Electric Vehicles Ev Charging Stations Can Benefit Your Business Ev Charging Stations Ev Charging Charging

2022 Ev Charging Incentives For New England Revision Energy

Tax Tips For Going Green In 2022 Electric Vehicle Charging Business Advisor Go Green

5 Ways Electric Vehicles Ev Charging Stations Can Benefit Your Business Ev Charging Stations Ev Charging Charging

Find Charging Options For Your Electric Vehicle Carolina Country

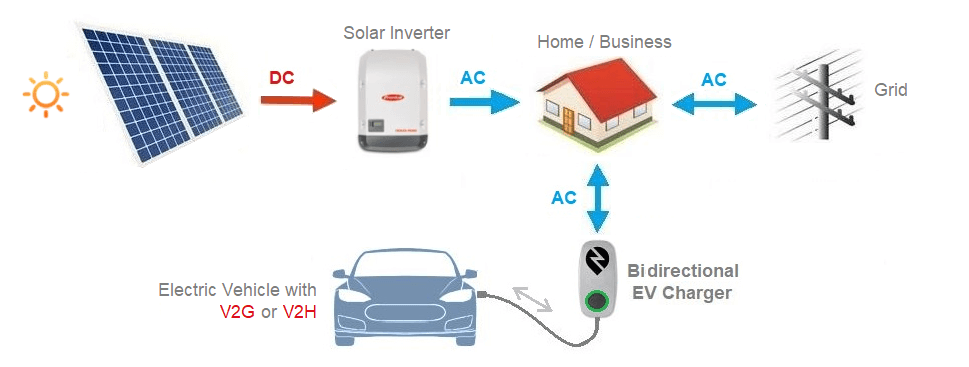

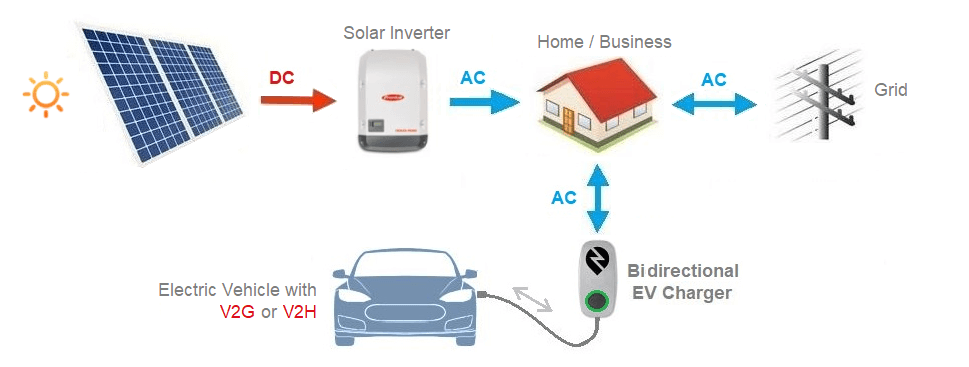

Bidirectional Chargers Explained V2g Vs V2h Vs V2l Clean Energy Reviews

Electric Vehicle Charger Installation

Rebates And Tax Credits For Electric Vehicle Charging Stations

Not Nearly Enough Money For Ev Charging In The Infrastructure Bill

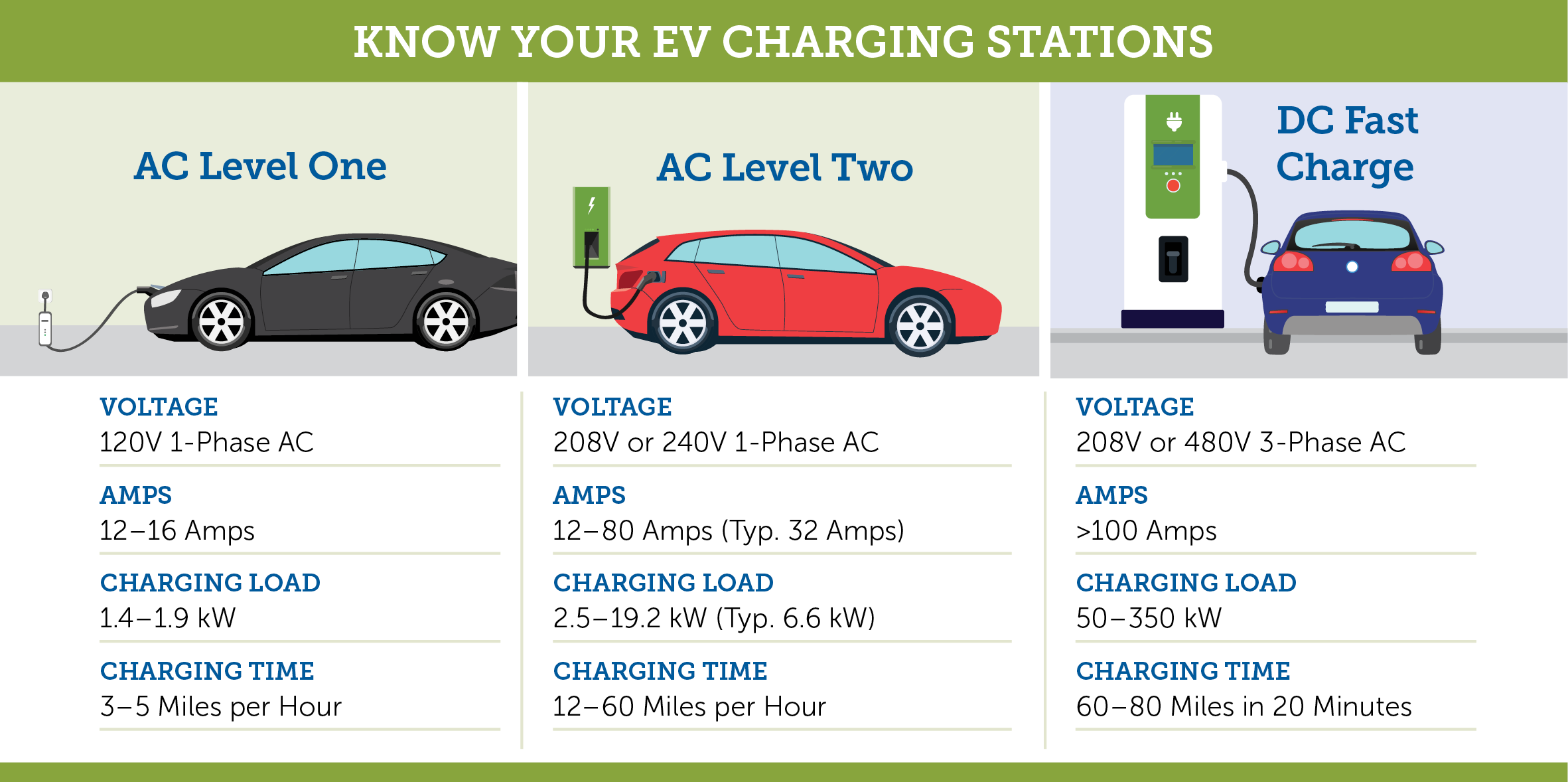

About Electric Vehicle Charging Efficiency Maine

How To Develop An Ev Charging Station Finder App Features Cost

Ev Charging Stations 101 Wright Hennepin

Best Level 2 Ev Charger Compare Chargepoint Juice Box Grizzl E Siemens Blink More

Plant Engineering Considering Electric Vehicle Charging Risks

Electric Car Charging Station Installation Cost Chart Electric Vehicle Charging Station Car Charging Stations Electric Car Charging

How To Claim An Electric Vehicle Tax Credit Enel X

Tax Credit For Electric Vehicle Chargers Enel X

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center